Low Cost Homeowners Insurance Calculated

The state of Kentucky Workplace of Insurance protection is an excellent source. For anyone in the condition looking for house owner’s insurance.

Although this office doesn’t offer suggestions regarding which broker or organization to deal with. So they are able to confirm if a business is certified to sell house owner’s insurance in the condition.

How much is homeowners insurance? This is important because buying a license from outside an organization that has a license can lead to many complications. Such as having trouble declaring it.

Low Cost Homeowners Insurance

If you’re looking for low cost homeowners insurance, you’re in luck. In this article, we’ll show you how to find the best rates and discounts on homeowners insurance.

We’ll also provide reviews of the top homeowners insurance companies so that you can find the best coverage at the best price.

So whether you’re just starting out or you’re looking to switch to a new provider, we’ve got you covered.

Get the Lowest Price on Homeowners Insurance

If you’re looking for a way to protect your home and your family, you’ll want to look into getting homeowners insurance.

There are a few things you can do to get the lowest price on homeowners insurance.

One way to do this is to compare quotes from different providers.

You can also ask your friends, family, and online communities for recommendations.

Remember to always shop around and find the best policy for you and your family.

Having homeowners insurance can help you feel more confident about your security and peace of mind.

What is Homeowners Insurance?

Homeowners insurance is a type of insurance that covers your home and its contents in the event of a loss.

It can help protect you and your family if something happens and you can’t afford to pay for the damages.

There are a few different types of homeowners insurance and each has its own pros and cons.

Here is a list of the most common types of homeowners insurance and their benefits.

- Property Insurance: This type of insurance covers your home and all of its contents, including the land on which it sits. This type of insurance is usually the most expensive, but it can also be the most comprehensive.

- Liability Insurance: This type of insurance covers you and any people who live in your home if someone else is injured or damages your home.

- Umbrella Insurance: This type of insurance covers you and your family if your home is damaged but does not cover the land on which it sits.

- Flood Insurance: This type of insurance covers your home if it is damaged in a flood.

- Wind Insurance: This type of insurance covers your home if it is damaged by wind.

- Homeowners Insurance Quotes: Compare quotes and find the best coverage for your home.

Homeowners insurance is a type of insurance that covers your home and its contents in the event of a loss.

What does Homeowners Insurance Cover?

Homeowners insurance protects your home and belongings from damage or theft. It can also pay for medical expenses and loss of income if you are unable to work due to a covered event.

Here are some of the things homeowners insurance typically covers:

- Damage from natural disasters, like floods and hurricanes

- Damage from accidents, like broken windows and theft

- Damage from vandalism

- Loss of income if you are unable to work because of a covered event

When you are comparing quotes, be sure to ask about what is not covered by your policy. Some policies only cover natural disasters, while others may not cover accidents or theft.

It is also important to ask about how many people are covered by the policy and what is the deductible. The deductible is the amount you have to pay before the insurance starts to pay out.

If you are in the process of buying a home and are wondering if homeowners insurance is right for you, be sure to compare quotes and read the policy documents.

What Factors Affect Homeowners Insurance Rates?

Homeowners insurance rates are affected by a number of different factors, some of which are more apparent than others.

- Accident history

- The type of home you live in

- The age of the home

- The location of the home

- The type of coverage you choose

Some of these factors are more apparent than others. Accident history, for example, is something that typically shows up on a state or national level driving record. If you have had a lot of accidents, your homeowners insurance rates will probably be higher than if you have had few accidents.

Another factor that affects homeowners insurance rates is the type of home you live in. Homes that are in high-risk areas, such as near a river or a busy highway, are likely to have higher premiums than homes that are not in high-risk areas.

Location is also something that can affect homeowners insurance rates. If your home is in a dangerous or hazardous area, your premiums may be higher than if your home is in a safe area.

Homeowners insurance rates can also be affected by the age of the home. Older homes are often more expensive to insure than newer homes.

Homeowners insurance rates can also be affected by the type of coverage you choose. If you choose to have comprehensive coverage, for example, your rates may be higher than if you choose to have only liability coverage.

How Can I Get the Lowest Price on Homeowners Insurance?

So you want the cheapest homeowners insurance possible, huh? Well, this is a tough question to answer because it really depends on a few things.

First and foremost, what are your personal requirements? Do you need comprehensive coverage? Do you need to be protected from storms? Do you want to be able to claim on your property if something happens?

Once you know what coverage you need, you can start looking for quotes.

One of the best ways to get a low homeowners insurance price is to compare quotes. You can use a website like Insure.com to get quotes from multiple companies.

You can also ask your friends, family, and online groups for quotes.

Just make sure you get quotes from a variety of companies so you can get an idea of the average price.

Once you have a ballpark idea of the price you want to pay, it’s time to shop around.

Be sure to compare rates and coverage to see which company has the best deal for you.

You can also contact the companies you’re considering to get a quote in person.

Do whatever you can to get the cheapest homeowners insurance price possible. It could save you a lot of money in the long run.

Compare Quotes and Reviews to Find the Best Homeowners Insurance

If you’re looking for affordable homeowners insurance, you’ll want to compare quotes and reviews first.

There are a number of great options out there, and it can be tough to decide which one is right for you.

That’s where reviews and quotes come in handy.

You can read reviews to see what other people have thought about the insurance company, and compare quotes to see which option is the best for you.

It’s important to do your research so you’re getting the best possible deal.

How Do I Compare Homeowners Insurance Quotes?

There are a few ways to compare homeowners insurance quotes.

One way is to go to a website like Insure.com and type in your zip code. They will show you quotes from all the different companies in your area.

Another way is to go to a local insurance agent and ask them to give you quotes.

The third way is to go to a comparison site like Insure.com and compare quotes from all the different companies.

Some people prefer the second way because they feel that the insurance agent is more biased towards one company over the other.

Ultimately, the best way to find the best homeowners insurance quote is to compare quotes from all three methods and choose the one that you are the most comfortable with.

What Should I Look for When Comparing Homeowners Insurance Reviews?

When you’re looking to compare homeowners insurance quotes, it’s important to take into account a few factors.

First and foremost, you’ll want to make sure the companies you’re comparing quotes with are licensed and insured in your state.

Next, you’ll want to look at the company’s history and reviews. Make sure they’re reputable and have a solid track record of providing quality service.

And finally, it’s important to compare the prices of the quotes you receive. Don’t be afraid to go with the company that offers the best price.

By taking these steps, you’ll be able to find the best homeowners insurance policy for your needs.

What Kinds of Discounts Can I Get on Homeowners Insurance?

So you’re thinking about buying a home and you’re wondering if you need homeowners insurance? You’re not alone. In fact, according to the National Association of Insurance Commissioners, nearly half of all homeowners do not have insurance.

Why not?

It can be a pretty affordable decision to go without it.

Here are a few things to keep in mind if you’re thinking about taking the plunge and going without homeowner’s insurance.

First, you’re taking the risk that something will happen to your home and you won’t be able to protect yourself.

This could mean losing your home or having to pay a lot of money to repair or replace it.

Second, if something does happen and you don’t have homeowner’s insurance, you could be liable for the costs.

This could include the cost of repairs, loss of income, and more.

And finally, if you do end up needing to file a claim, you’ll probably have to pay a lot of money for the privilege.

So if you’re thinking about buying a home and aren’t sure if you need homeowners insurance, it might be a good idea to compare quotes and see what discounts are available to you.

Understand Your Homeowners Insurance Policy

Understanding your homeowners insurance policy is key to finding the best deal.

In order to get the best deal, you first need to know what is covered and what is not.

Your policy will typically cover your home, your contents, and your liability.

However, there are some exclusions that you need to be aware of.

For example, your policy may not cover damage caused by a natural disaster, such as a tornado.

Additionally, your policy may not cover your home if it is abandoned.

And finally, your policy may not cover damage caused by a thief.

Knowing these exclusions will help you save money on your homeowners insurance.

(Key takeway): Understanding your homeowners insurance policy is key to finding the best deal. By knowing what is and is not covered, you can save money on your policy.

What Does Liability Insurance Cover?

Liability insurance covers you and others who are responsible for your actions, whether it is intentional or accidental. This type of insurance protects you from lawsuits and financial damages that may come as a result of an incident.

Some common types of coverage include:

Property damage: This covers damage to your home or personal property that you may have caused.

This covers damage to your home or personal property that you may have caused. Personal injury: This covers injuries that you or someone you’re responsible for has caused to another person.

This covers injuries that you or someone you’re responsible for has caused to another person. Business interruption: This covers lost profits or revenue that you may have caused as a result of an incident.

Some things that will not generally be covered by liability insurance include:

Faulty wiring: This is covered if there is a defect in the wiring, whether it was done by you or by someone else.

This is covered if there is a defect in the wiring, whether it was done by you or by someone else. Driving under the influence: This is not covered unless you were operating a vehicle while under the influence of alcohol or drugs.

This is not covered unless you were operating a vehicle while under the influence of alcohol or drugs. Defective products: This is not covered unless the product was manufactured by the insurance company.

What Does Personal Property Insurance Cover?

Personal property insurance covers any items of value that are inside your home, like furniture, appliances, electronics, and even pets.

This type of insurance is important because it protects your belongings from theft or damage while you are not home.

If you have personal property insurance, you will usually be required to maintain it. This means that you will need to file a claim if something happens to your belongings and the insurance company will pay for the damage or theft.

Personal property insurance is a good way to protect your belongings and keep your home protected in case of a disaster.

Compare quotes and reviews to find the best homeowners insurance for you.

What Is Replacement Cost Coverage?

Replacement cost coverage is a type of homeowners insurance that pays for the cost of replacing your home if it is destroyed by a covered peril.

The policy usually has a limit on the amount that it will pay out, and the policyholder is responsible for finding the money to cover the remaining balance.

This coverage is important for two reasons.

First, it can help to cover the costs of replacing your home if it is damaged by a covered peril.

Second, it can help to cover the costs of repairing your home if it is damaged by a covered peril.

If you are in the market for a replacement cost homeowners insurance policy, be sure to compare quotes and reviews to find the best option for you.

Replacement cost coverage is a type of homeowners insurance that can help to cover the costs of replacing your home if it is damaged by a covered peril.

Be sure to compare quotes and reviews to find the best option for you.

What Is Sewer Backup Coverage?

Sewer backup coverage is a type of insurance that protects your home from sewer backup. A sewer backup can happen when a large amount of wastewater (sewage) is released from a sewage treatment plant, a broken pipe, or a clogged drain.

A sewer backup can cause major damage to your home, including water damage, flooded floors, and damage to your plumbing and electrical systems. If you’re ever a victim of a sewer backup, having coverage from your homeowners insurance can help you get the repairs you need and make your home secure again.

To find the best sewer backup coverage for your home, compare quotes from different insurers. You can also read reviews of homeowners insurance policies to find information about coverage that other people have found useful.

Homeowners Insurance Tips to Save Money

One way to save money on homeowners insurance is to compare quotes. You can find a variety of companies and prices to choose from.

Another way to save money on homeowners insurance is to have a low deductible. A low deductible means that you pay a smaller portion of the claim in the event of a claim. This can save you a lot of money in the long run.

If you have a home that is your primary residence, you may be able to get lower rates if you have a good homeowners insurance policy. You can also get a homeowners insurance policy that includes flood insurance. Flood insurance can help you in the event that your home is damaged by a flood.

If you are looking to save money on homeowners insurance, comparing quotes and having a low deductible are two good ways to do it.

How Can I Lower My Homeowners Insurance Premium?

If you’re looking to save on your homeowners insurance premium, there are a few things you can do.

First, make sure to keep your home up to date with the latest safety and security features.

Second, review your policy to see if there are any discounts you may be eligible for.

And finally, speak to a representative from your insurance company to see if there are any other options available to you.

All of these steps will help you lower your homeowners insurance premium, and ultimately save money.

What Is An Insurance Deductible?

So, you’ve decided to buy a home. Congratulations! The next step is to figure out what kind of home insurance you need.

One of the first things you’ll need to decide is what kind of coverage you want. You have three options:

- Full coverage: This will include everything from property damage to personal liability.

- Comprehensive coverage: This will include property damage and personal liability, but not liability for accidents on your property.

- Limited coverage: This will only cover property damage.

The next decision you’ll need to make is whether or not to have a homeowner’s insurance deductible. A deductible is a set amount you pay before your insurance policy begins to cover any losses.

The downside to having a deductible is that it means you’ll have to pay out of pocket for any losses that occur. The upside is that it can save you money on your insurance policy.

Depending on your situation, you may be better off choosing either limited or comprehensive coverage. But, whichever option you choose, make sure to get quotes from several different companies so you can get the best deal.

Having a homeowner’s insurance deductible can save you money on your policy, but it comes at the cost of having to pay out of pocket for any losses.

Choosing either limited or comprehensive coverage is the best way to maximize your savings while still having enough coverage to protect you from accidents on your property.

What Homeowners Insurance Perils Are Covered?

Homeowners insurance protects you and your family from the many perils that can happen when you live in your home.

It can cover things like theft, fire, and vandalism.

There are a few things to keep in mind when choosing homeowners insurance.

The first is to make sure that the policy covers the type of dwelling you live in. This means that it must cover your home, whether it’s a condo, a house, an apartment, or a mobile home.

The second is to make sure that the policy covers the type of property you live on. This means that it will cover the land on which your home is located, as well as any structures on that land.

The final thing to keep in mind is the deductible. This is the amount of money that you have to pay out of pocket before the policy begins to cover any losses.

Homeowners insurance can help protect you and your family from perils such as theft, fire, and vandalism. Make sure to choose a policy that covers your dwelling type and property type, and have a deductible in mind to ensure you are covered.

What Homeowners Insurance Perils Are Not Covered?

Homeowners insurance protects you and your family from a variety of perils, including fire, theft, and natural disasters.

But not all perils are covered by homeowners insurance. Here are a few that are not:

Catastrophic events, such as a tornado, hurricanes, or earthquakes.

- Damage is caused by a guest, such as when they break a window or damage property.

- Damage caused by animals, such as a skunk damaged your roof.

- Damage is the result of civil unrest, such as rioting.

- Damage is the result of war, such as a bomb going off.

Some of these perils are common, but others are not. If you are not sure whether a peril is covered by your homeowners insurance, contact your insurance provider.

Homeowners insurance can be a great way to protect yourself and your family from a variety of perils. Make sure to check the coverage that is offered to you, and contact your insurance provider if you have any questions.

Get the Coverage You Need at the Lowest Price

If you are looking for homeowners insurance, you may be wondering if there are any low cost options available.

There are a few ways to find homeowners insurance that will fit your budget.

One way is to compare quotes from different insurance companies.

When you compare quotes, make sure to include the type of coverage you need and the price you are willing to pay.

You can also try finding homeowners insurance through a broker.

A broker can help you find a policy that fits your needs and budget.

So if you are looking for homeowners insurance that will fit your budget, you can start by comparing quotes and then finding a broker who can help you find the coverage you need.

What Is an Insurance Policy Endorsement?

An insurance policy endorsement is a document that is added to an insurance policy to show that the policyholder is qualified for the coverage that they have purchased.

This document can be important if the policyholder has a particular profession or if they have a particular type of insurance.

For example, a policyholder who owns a home may need to have an insurance endorsement to show that they are qualified for the home insurance that they have purchased.

What Is an Insurance Policy Exclusion?

A homeowners insurance policy exclusion is a clause in a policy that allows you to protect yourself and your property from certain risks.

Typically, these risks are things that are not covered by the policy, such as damage caused by a natural disaster.

There are a few things to keep in mind when shopping for homeowners insurance.

The first is to make sure you are aware of all the policy exclusions.

Secondly, be sure to compare quotes to find the policy that is right for you.

Finally, be sure to keep your policy up to date. Changes in your personal or property insurance may necessitate an adjustment to your homeowners policy.

1. A homeowners insurance policy exclusion is a clause in a policy that allows you to protect yourself and your property from certain risks.

2. Make sure you are aware of all the policy exclusions.

3. Compare quotes to find the policy that is right for you.

4. Keep your policy up to date. Changes in your personal or property insurance may necessitate an adjustment to your homeowners policy.

Should I Get an Umbrella Liability Policy?

When it comes to homeowners insurance, many people are unsure of what type of policy is right for them.

There are a few things to keep in mind when deciding whether or not to get an umbrella liability policy.

The first is whether or not you are likely to be sued. If you are a high-risk homeowner, an umbrella liability policy may be the best way to protect yourself.

If you are sued and found at fault, an umbrella policy will help cover the costs associated with the lawsuit, such as attorneys’ fees and damages.

Another important factor to consider is your deductible. Once you have met your deductible, the insurance company will start to pay out on claims.

If you have a low deductible, you may not benefit from an umbrella policy as much.

In the end, it is important to talk to an insurance agent to get a better idea of what is best for you.

- An umbrella liability policy can help you protect yourself from lawsuits.

- It is important to decide if you are likely to be sued and your deductible.

- An umbrella policy pays out on claims once you have met your deductible.

What Is an Insurance Claims Adjuster?

Claims adjusters are responsible for making sure that insurance companies pay out on claims in a timely and accurate manner.

This is typically done by reviewing the evidence and making a determination as to whether the claim meets the company’s deductible or coverage.

If the claim is determined to be within the deductible or coverage, the claims adjuster will work to get the insurance company to pay the claim as quickly as possible.

If the claim is not within the deductible or coverage, the claims adjuster will work to get the insurance company to reimburse the claimant for any losses incurred.

Claims adjusters are typically hired by insurance companies, but they can also be self-employed. They typically have a degree in business, law, or accounting.

Conclusion

Conclusion Homeowners insurance is a necessity for most people, but finding the right policy can be a daunting task. With so many companies vying for your business, how can you be sure you’re getting the best deal?

One way to find the best home insurance policy is to compare quotes from different providers. Reviewers on Insure.com can help you find the best policy for your needs, whether you’re looking for comprehensive coverage or a specific type of policy.

Insure.com also offers a home insurance calculator to help you estimate your monthly premiums. This tool allows you to input the details of your home and see how your coverage would stack up against the competition.

If you’re ready to start protecting your home and your belongings, start searching for low cost homeowners insurance quotes today!

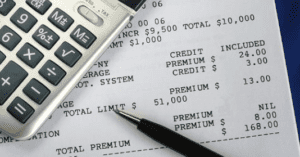

Low-Cost Homeowners Insurance Calculator

When you are looking for affordable and low cost homeowners insurance calculator plan.

It’s crucial that you try to find quotations from several different organizations.

Any viewpoint cheap home insurance organization will likely check your history to see if you’ve had any statements.

If you have you can anticipate your replacement value and insurance rates to be greater.

Home Insurance Premium Calculator

Asking for more insurance liability should be something you do with every organization you contact.

Most will have a predetermined average cost of homeowners insurance estimate deductible that will be below $500.

If you ask for more deductible on non standard home insurance. The cost of high quality will be lower.

If you don’t predict making any statements in the near future, this is a wonderful way to save cash.

Even increasing your deductible to $1,000 or $2,000 can have a big impact on your point here.

Non Standard Home Insurance for High-Risk Properties

Be sure that when determining the cost of modifying the house you do not take into account. That prices in the area.

And that’s why they invest more in rates than they need.

Only guarantee the house and any other structures on the property. Such as a garage area.

So this will help you enjoy everything home insurance calculator you need to cheap rates.